Did you know the insurance claims industry deals with over $1 trillion in claims each year in the United States? It’s important to know how the insurance claims process works. This way, you can make sure you get the coverage and benefits you deserve. In this guide, we’ll explain the insurance claims process from start to finish.

We’ll talk about the main steps, the role of insurance adjusters, and how to handle disputes. We’ll also share tips on avoiding insurance fraud. Knowing the process can make your experience smoother and help protect your financial health.

Key Takeaways

- The insurance claims industry handles over $1 trillion in claims annually in the United States.

- Understanding the insurance claims process is crucial to ensure you receive the coverage and benefits you’re entitled to.

- The guide covers the key steps, the role of insurance adjusters, handling disputes, and strategies to prevent insurance fraud.

- By understanding the process, you can ensure a smooth experience and get the coverage you need to protect your financial well-being.

- The guide provides a comprehensive overview of the insurance claims process, from filing your claim to receiving a fair settlement.

Understanding the Importance of Insurance Claims

Insurance claims are key to managing risks and keeping your finances safe. They help you protect yourself and your assets when unexpected things happen. We’ll look at how insurance claims in comprehensive risk management and financial protection work together.

The Role of Claims in Risk Management

Insurance claims are vital for managing risks. They help when unexpected events like property damage or theft happen. By filing a claim, you can get the money you need to fix things and stay financially stable.

Protecting Your Financial Well-being

The importance of insurance claims goes beyond just managing risks. They also help keep your finances safe in the long run. When unexpected events happen, claims can give you the money you need to avoid financial trouble.

| Benefit | Description |

|---|---|

| Financial Security | Insurance claims can help you cover the costs of repairs, medical bills, or other expenses, ensuring your financial security is not compromised. |

| Asset Protection | By filing a successful claim, you can protect your valuable assets, such as your home, vehicle, or personal belongings, from the financial consequences of unexpected events. |

| Stress Reduction | The claims process can provide you with peace of mind, as it helps alleviate the financial burden and stress associated with unexpected incidents. |

In summary, insurance claims are crucial for managing risks and protecting your finances. By understanding their role, you can take steps to keep your finances safe and handle life’s surprises with confidence.

Filing an Insurance Claim: The Initial Steps

Starting the insurance claims process can feel overwhelming. But, with the right steps, you can make it easier. First, get to know your policy and what it covers.

After understanding your coverage, report the incident to your insurance company. You can call, go online, or use a mobile app. Be ready to share the details of what happened, like when and where it happened.

- Review your insurance policy to understand the coverage details.

- Contact your insurance provider to report the incident and initiate the claims process.

- Gather any necessary documentation, such as receipts, photos, or police reports.

- Cooperate with the insurance adjuster during the investigation process.

- Follow up with your insurance provider to ensure the timely processing of your claim.

The claim initiation process is key to a successful claim. Knowing your policy and giving the right info helps. This way, you can make the filing insurance claim smoother and more likely to succeed.

“The key to a successful insurance claim is to be proactive, organized, and diligent throughout the process.”

By taking these first steps, you’re on the right path. You’ll be able to handle the insurance claims process better. And, your insurance company is there to help, so don’t be afraid to ask for help.

Gathering Necessary Documentation

When you start an insurance claim, you need to be very careful. The first step is to collect the right documents. This is key for claims about property damage, theft, or other covered incidents. You must show proof of ownership and the extent of the loss.

Proof of Ownership and Loss

You must prove you own the damaged property or assets. This can be done with receipts, purchase records, or photos. You also need to show how much was lost or damaged, like repair estimates or police reports.

Policy Details and Coverage Information

It’s also crucial to know your insurance policy well. Check your policy to see what’s covered and what’s not. Look for any deductibles, limits, or exclusions. Keeping your policy details up to date helps your claim match your coverage.

| Documentation Needed | Purpose |

|---|---|

| Proof of Ownership | Demonstrate your legal ownership of the affected property or assets |

| Proof of Loss | Provide evidence of the extent and nature of the damage or loss |

| Policy Details | Confirm the specific coverage and terms of your insurance plan |

By carefully collecting and organizing your insurance claim documentation, proof of loss, and policy details, you’re setting up a strong claim. This focus on detail can make the claims process smoother. It helps protect your financial health.

Insurance claims process: Navigating the Process

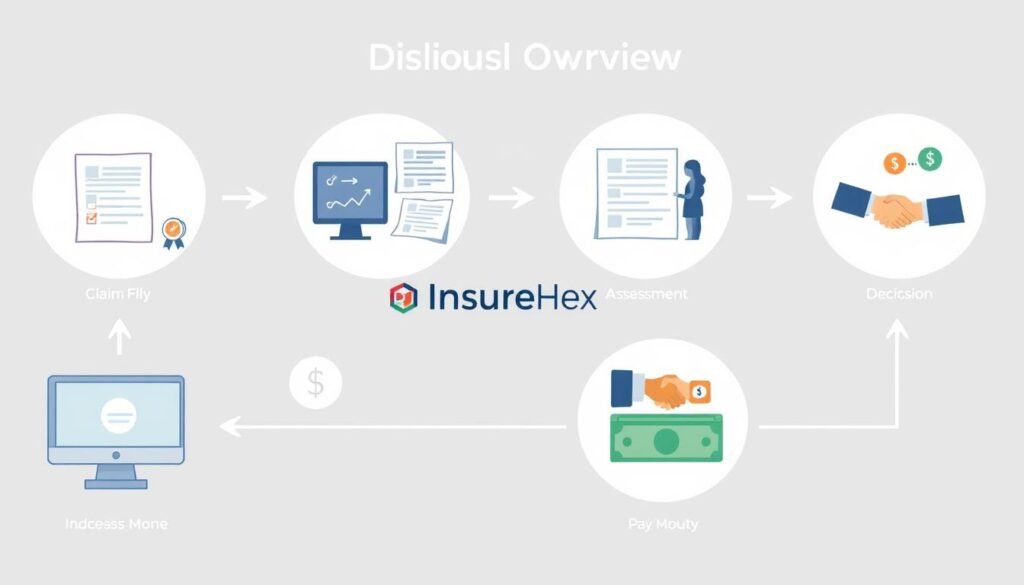

Knowing how to handle insurance claims is vital for keeping your finances safe. It’s a complex journey, but with the right help, you can get through it. Let’s look at the main steps in the insurance claims process, from starting the claim to getting the settlement.

The Claim Filing Process

The first step is to file a claim with your insurance company. You’ll need to fill out a claim form and give details about the incident. You’ll also have to send in any supporting documents, like receipts or police reports.

Claim Evaluation and Adjustment

After you file the claim, the insurance company will check the details. They’ll then assign an adjuster to look into the case. The adjuster will figure out how much damage there is, if you’re covered, and how much to offer in settlement.

| Claim Processing Steps | Timeline |

|---|---|

| Filing the Claim | Immediate |

| Claim Evaluation | 1-2 weeks |

| Adjuster’s Investigation | 2-4 weeks |

| Settlement Offer | 4-6 weeks |

| Final Payment | 6-8 weeks |

The time it takes can change based on how complex the claim is and the insurance company’s rules.

Reaching a Settlement

After the investigation, the insurance company will make a settlement offer. You can accept it, try to negotiate, or disagree with it. The goal is to find an agreement that fairly covers your loss.

Good communication, detailed records, and patience are crucial during the insurance claims process. By knowing the steps, you can confidently go through the process and protect your finances.

The Role of Insurance Adjusters

Insurance adjusters are key in the claims process. They check your claim, see how much damage there is, and figure out how much to pay. Knowing their role helps you get ready and fight for your claim.

Investigation and Evaluation

When you file a claim, an adjuster gets assigned. Their main jobs are:

- Looking into the incident or loss that caused your claim

- Figuring out how much damage there is and what it costs to fix or replace

- Deciding how much to pay based on your policy

To do this, the adjuster might talk to you, look at papers, and check the damaged area. They aim to get all the info they need to make a fair claim decision.

The adjuster’s job is vital for fair and quick claims handling. Knowing what they do helps you work with them better and get a good outcome for your claim.

Claim Settlement: Reaching a Resolution

Insurance claim settlement aims for a fair and quick resolution. It involves several steps, from figuring out the settlement amount to getting your money. Knowing how claim settlement works helps ensure you get the coverage you deserve.

The settlement amount is based on the insurance adjuster’s investigation. They look at your loss, coverage limits, and any deductibles or depreciation. The goal is to pay you enough to cover your expenses, following your policy’s rules.

After figuring out the settlement amount, the insurance company will pay you. How long it takes to get your money can vary. But, most insurers try to do it within 30 days. Sometimes, it takes longer if they need more information or to do more checks.

To make the claim settlement process smoother, keep in touch with your insurance company. Be quick to respond to any requests for more info or documents. Working together can help you get a successful insurance claim settlement and claim resolution.

| Key Factors in Claim Settlement | Timeline for Payout |

|---|---|

|

|

“The key to a successful claim settlement is communication and collaboration between the policyholder and the insurance provider.”

Handling Disputes and Denied Claims

Not all insurance claims get approved or settled right. When disputes or denials happen, knowing your options is key. We’ll look at ways to handle these situations and get the benefits you deserve.

Appeals and Mediation Options

If your claim is denied, you can appeal. The appeals process means providing more evidence to support your claim. It’s a detailed step, but it’s often the first move in dispute resolution before looking at legal actions.

Mediation is another choice. It’s a team effort with a neutral third party to find a solution. This method can help resolve denied insurance claims without expensive lawsuits.

Legal Recourse

If appeals and mediation don’t work, you might need to go to court. This step is complex and takes time. Think carefully about the costs and benefits before starting a lawsuit.

Knowing your rights and the appeals process is vital when facing a denied claim. By trying all options, you can get a better outcome and protect your finances.

“Persistence and determination alone are omnipotent.” – Calvin Coolidge

Preventing Insurance Fraud

Insurance fraud is a big problem that affects both policyholders and insurance companies. It happens when people lie to get benefits they shouldn’t have. Knowing the signs and taking steps to prevent it can protect our claims and keep the insurance system honest.

Recognizing the Threat of Insurance Fraud

In today’s world, technology helps catch insurance fraud. Scammers try to trick the system by lying about their claims or exaggerating what they lost. It’s important for us to know how they work and watch out for anything that seems off.

Knowing our rights and what the law says about insurance is key. This way, we can spot fraud and make smart choices.

Safeguarding Your Claims

- Keep all your insurance papers and records safe and organized.

- Double-check every piece of insurance mail and claim to make sure it’s right.

- Be cautious of offers that seem too good to be true or pressure to buy insurance fast.

- If you think something is wrong, tell your insurance company and the right authorities.

By being proactive, we can help stop insurance fraud and protect our claims. Working together, we can keep the insurance industry trustworthy and safe for everyone.

“The best defense against insurance fraud is a well-informed and vigilant policyholder.”

Claim Filing Procedures: A Step-by-Step Guide

Filing an insurance claim can seem hard, but it’s easier with a few steps. You can handle claims for property damage, theft, or other incidents smoothly. Knowing the right steps is key.

Timelines and Deadlines

Following the right timelines and deadlines is very important. Insurance companies have rules for when to report and submit claims. Missing these deadlines can hurt your claim. So, it’s important to know the insurance claim filing procedures and timelines.

- Report the incident to your insurance right away, as they have strict time limits.

- Collect all important documents, like damage photos, repair estimates, and police reports, quickly.

- Send in your claim and documents on time to get it processed fast.

By following the insurance claim filing procedures, claim submission timeline, and claim deadlines closely, you can handle the process well. This increases your chances of a successful claim outcome.

“Following the proper insurance claim filing procedures and timelines is crucial for a successful claim resolution.”

Insurance Claim Requirements: Know Your Rights

As policyholders, it’s key to know your rights and what’s needed for an insurance claim. The claims process can seem tough, but knowing your stuff helps you fight for what’s yours. This way, you get a fair deal.

Start by reading your insurance policy well. It tells you what’s covered, what you have to pay first, and what your insurance company must do. Knowing this helps you get ready for the claims process without surprises.

One big insurance claim requirement is telling your insurance company right away. Most policies have a time limit for claims. Giving them all the details of what happened helps speed things up.

You also have the right to a fair claim check. Adjusters figure out how much you should get. If you think your claim is not being treated right, you can ask for a second look or take it to court.

Knowing your policyholder rights and the insurance claim requirements gives you confidence in the claims process. It helps make sure your needs are met. By being informed and standing up for your rights, you’re more likely to get a good outcome.

“Knowing your rights as a policyholder is the first step towards a successful insurance claim resolution.”

Claim Documentation: Ensuring Accuracy

Having accurate and detailed documentation is key to a successful insurance claim. It’s vital for protecting your financial health. Keeping good insurance claim documentation and record-keeping practices is essential. It helps prove your loss and makes the claims process smoother, leading to a quicker and better result.

Record-Keeping Best Practices

To support your insurance claim with the right evidence, follow these record-keeping tips:

- Keep detailed lists of your belongings, including what they are, when you bought them, and their value.

- Take photos and videos of any damage or loss, showing it from different sides.

- Collect receipts, invoices, and other financial documents that back up your claim.

- Save copies of your insurance policy, any letters from your provider, and all documents you’ve sent in.

- Make a timeline of what happened, including when the incident occurred and what you did next.

By sticking to these record-keeping tips, you’ll have a solid and organized paper trail for your insurance claim. This increases your chances of getting a positive outcome.

“Proper documentation is the key to a successful insurance claim. It not only protects your rights but also streamlines the process, ensuring you receive the compensation you deserve.”

Claim Investigation: What to Expect

When you file an insurance claim, your provider starts an investigation. This is key to figuring out how much you’ll get. Knowing what the insurance adjuster does and what they look for is important.

The insurance adjuster is in charge of a detailed insurance claim investigation. They look into your loss or damage, collect important documents, and check your policy. This careful claim evaluation process helps them figure out if your claim is valid and how much it’s worth.

- The adjuster might ask for things like receipts, photos, or repair estimates to check your claim.

- They could also talk to you, witnesses, or others to get more info.

- In some cases, they might need to see the damaged property or get experts to assess it.

After they finish their investigation, the adjuster will look over all the info. Then, they’ll suggest how much your insurance should pay. This decision is based on your policy and what they found during the insurance claim investigation and claim evaluation process.

| Key Factors in Claim Evaluation | Description |

|---|---|

| Policy Coverage | The adjuster checks your policy to see what’s covered and how much. |

| Documented Evidence | They look at the documents you give them, like receipts and photos, to see how bad the damage is. |

| Circumstances of the Claim | They also look into what happened, including any other factors that might have played a part. |

Knowing about the insurance claim investigation and claim evaluation process helps you get ready. It makes sure your rights are looked after and you get the right amount of compensation.

Home Insurance Essentials: Protect Your Property

Claim Payout: Receiving Your Benefits

The final stage of the insurance claims process is receiving your well-deserved payout or settlement. You’ve gone through the complex journey of documenting your loss and working with the insurance adjuster. Now, the insurance provider will transfer the approved funds to you.

The time it takes to get your claim payout varies. It depends on the insurance company’s processes and your case’s complexity. Usually, you’ll get the payment in a few weeks to a month after approval. You might get it through a direct bank transfer, a physical check, or a debit card.

It’s crucial to review the payout details carefully. The insurance provider might need to make adjustments based on your policy. We aim to ensure you get the full and fair compensation you’re entitled to. So, double-check the calculations and contact your insurance representative if you have questions or concerns.